Local & County Business Tax Receipts

First and foremost, the Business Tax Receipt is proof of payment of the business tax. It is required before a business opens. Local business tax receipts(BTR) are issued by the Tax Collector’s Office. They are payable annually July 1 through September 30. They expire on September 30 and can be renewed on or after October 1. Paul J. Burkhart can assist with any local or business tax receipts.

*Additionally, anyone who does not pay the business tax is subject to civil actions and penalties. Examples of penalties include court costs, reasonable attorneys’ fees, additional administrative costs incurred as a result of collection efforts, and a penalty of up to $250 (Florida Statute 205.053).

All companies (One-person and home based companies included) in Palm Beach County selling merchandise or services are required to purchase a Business Tax Receipt. Here is the link for the Application for Business Tax Receipt:

Fees

The most common fee is $33 and is charged to businesses with 10 or fewer employees. The fees increase proportionately to the number of employees a business has. The maximum fee is $236.25 for a company or business with 51 or more employees. Different businesses may follow different guidelines. For ex., restaurants and contractors follow different guidelines for Business Tax Receipts.

This link shows the different types of businesses and the fees associated so you can ensure you are paying the correct amount:

Delinquent Local Business Tax Receipts

Local business tax receipts expire September 30 and may be renewed on or after July 1. Those receipts not renewed by September 30 are delinquent and subject to the following delinquency penalties:

- October 1 = 10% penalty

- November 1 = 15% penalty

- December 1 = 20% penalty + $10.00 collection fee

- January 1 = 25% penalty + $10.00 collection fee

If September 30 falls on a weekend or holiday, the tax is due and payable on or before the first working day following September 30.

The maximum annual penalty is 25%.

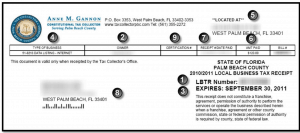

Tax Receipt Sample

Account Number: This is a unique number assigned to each business. Please refer to this number when making inquiries.

- Business Owner(s): Verify the ownership. If this is NOT correct, contact the Tax Collector’s office at (561) 355-2272.

- Expiration Date: This Tax Receipt expires on the date shown. Renewal notices are mailed in July and are due by the end of September.

- Type of Business: Verify the business type. If this is NOT correct, contact the Tax Collector’s Office at (561) 355-2272.

- Business Location: Verify the location. If this is NOT correct, contact the Tax Collector’s Office at (561) 355- 2272. If you have moved a new application and zoning approval is required to change the address. (see our web site for new application form and instructions)

- Amount Paid: This is the amount you paid, based on the type of business you own.

- Receipt Number/Date Paid: Verify the receipt has been validated by the Tax Collector’s Office. If it is NOT and you have paid your fee, contact the Tax Collector’s Office at (561) 355-2272. This also displays the date paid.

- Mailing Address: Mailing address we have on record for this account. All correspondence will be mailed to this address.

- Certification Number: Field completed if mandated by Florida Statutes, County Ordinance or Roadside Vendor.

Business Attorney Palm Beach Gardens

Our team assists both individual and business clients with all their legal needs. This includes Business and Corporate Transactions, Business/Commercial and Civil Litigation, Real Estate, Intellectual Property, Family Law, and Estate Planning matters. We are a full-service private law firm ready to assist you with any request, large or small.

Call 561-880-0155 or visit our website.

Law Offices of Paul J. Burkhart, PL

800 Village Square Crossing

Palm Beach Gardens, FL 33410

Phone: (561) 880-0155

© Copyright 2017. All Rights Reserved.